unemployment tax break refund how much will i get

You May Owe the IRS Money. How to calculate how much will be returned The IRS is in the process of sending out tax refunds for unemployment benefits recipients who mistakenly paid tax.

4 Filing Tips To Ensure You Get Your Tax Refund Asap Tax Refund Income Tax Irs

This tax break was applicable.

. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break. 24 and runs through April 18. Did You Receive Unemployment in 2021.

In the latest batch of refunds announced in November however the average was 1189. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a. Tax season started Jan.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The measure allows each person to exclude up to.

Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan. If you are married each spouse receiving unemployment compensation may exclude up to 10200 of their unemployment compensation. IR-2021-159 July 28 2021.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Theres no tax break for unemployment benefits received last. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic.

Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all filing statuses in 2020. If your modified AGI is 150000 or more you cant exclude any. The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and qualify for the 10200 tax break.

If I paid taxes on unemployment benefits will I get a refund. Amounts over 10200 for each individual are still taxable. The 19 trillion Covid relief bill gives a tax break on unemployment benefits received last year.

Generally unemployment compensation is taxable. Refund for unemployment tax break. The tax agency recently issued about 430000 more refunds averaging about 1189 each.

The federal tax code counts jobless benefits.

6 383 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

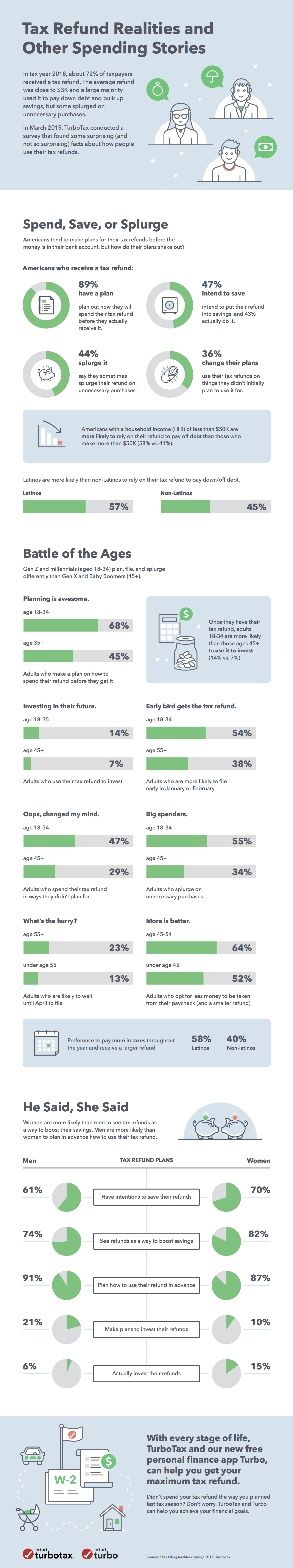

Tax Refund Realities And How Americans Spend And Save Their Tax Refunds Infographic The Turbotax Blog

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

Tax Refund Timeline Here S When To Expect Yours

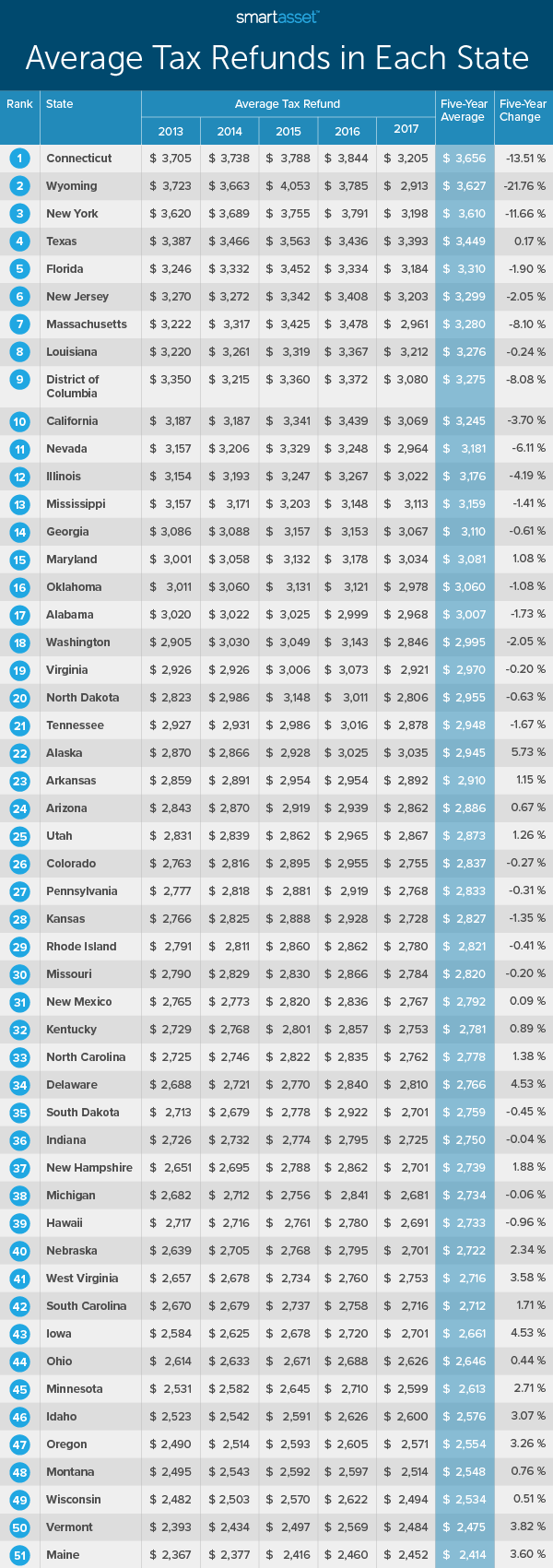

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs Refund Timeline 2022 R Turbotax

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

4 Steps From E File To Your Tax Refund The Turbotax Blog

Tax Refund Timeline Here S When To Expect Yours

Get Your Tax Refund Early File Now For Fast Return Of Refunds Stock Illustration Illustration Of Fast Financial 31864474

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer 6abc Philadelphia

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor